Why Tracking Your Solana Portfolio and Yield Farming SPL Tokens Is a Game Changer

Okay, so check this out—managing a crypto portfolio feels like juggling flaming swords sometimes. Especially when you’re knee-deep in the Solana ecosystem, where SPL tokens pop up faster than you can say “DeFi.” I was scratching my head the other day, wondering how folks keep track of their investments without losing their minds. Seriously, it’s a mess if you don’t have the right tools.

At first glance, I thought, “Eh, a simple spreadsheet should do the trick.” But then I realized—no way. The sheer volume of tokens, staking rewards, and yield farming opportunities means you gotta be smarter than that. Something felt off about relying on manual tracking. It’s just too easy to miss out on yields or worse, lose sight of your SPL tokens’ actual performance.

Here’s the thing: yield farming on Solana is incredibly attractive because of its speed and low fees, but that also means your portfolio can morph quickly. One day you’re hodling a handful of tokens; next thing, you’re swimming in dozens, some staked, some locked, some farming. It’s wild. And honestly, keeping tabs on it all is a full-time gig.

Whoa! Did I mention the risks? Yield farming sounds lucrative, but without clear tracking, you might stake your tokens and forget about them—earning way less than you could, or missing out on better opportunities. I’m guilty of that myself. It bugs me that even with all these shiny DeFi protocols, tools to manage your assets efficiently are still playing catch-up.

So, I dug deeper into the ecosystem, hunting for a wallet and portfolio tracker that doesn’t just hold your tokens but helps you see the bigger picture. That’s when I stumbled onto something pretty slick.

The Power of a Dedicated Solana Wallet for Portfolio Tracking

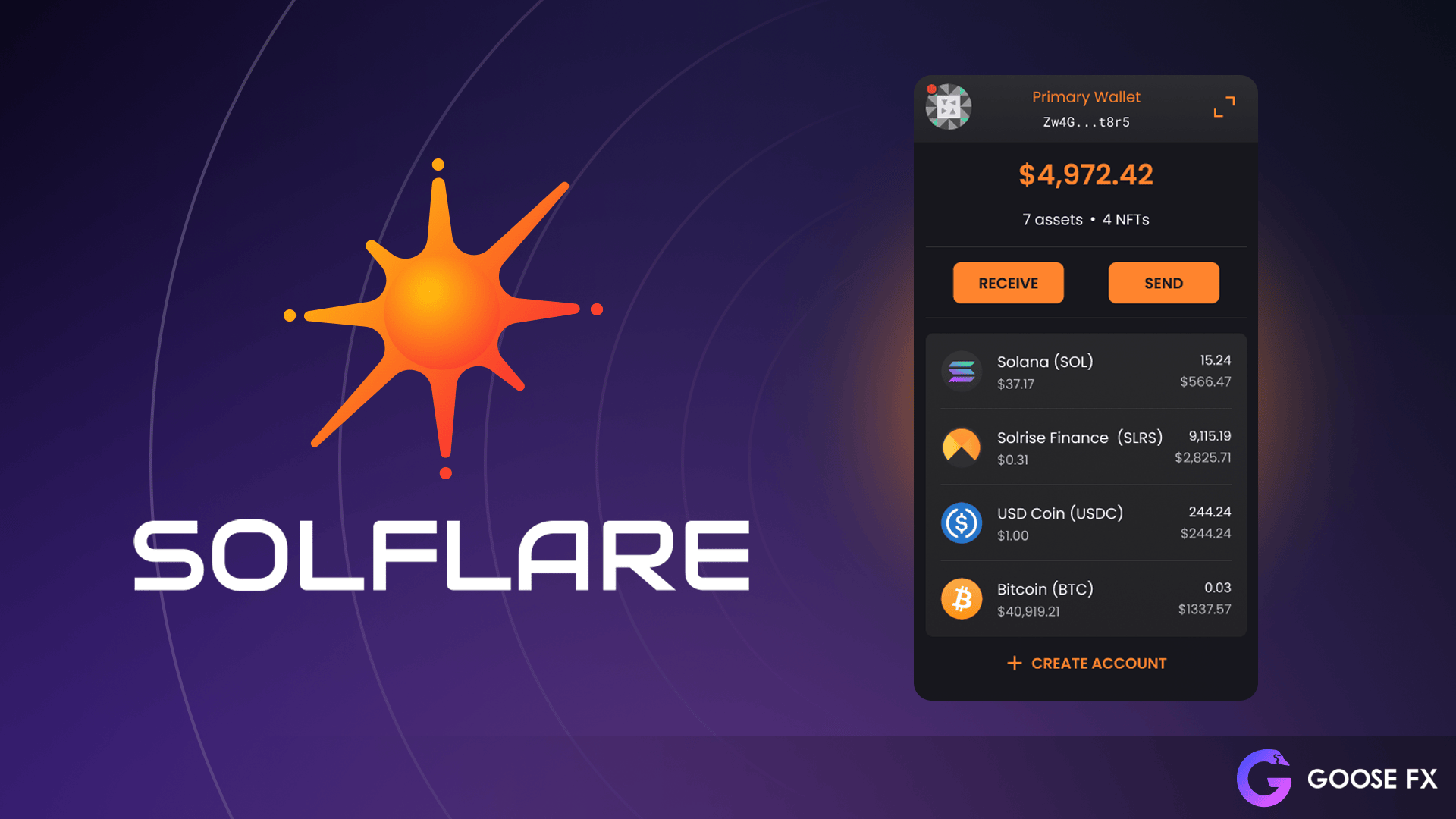

At first, I was skeptical about wallets that also claim to be portfolio trackers. My instinct said, “They’re probably bloated apps trying to do too much.” But then I tried the Solflare wallet—it genuinely surprised me. Not only does it support SPL tokens seamlessly, but its interface lets you monitor your staking, yield farming, and token holdings all in one place. For anyone serious about Solana DeFi, this is a very very important feature.

Now, I’m biased here because I’ve been using Solflare for a while, but the ease of managing multiple DeFi positions without hopping around different sites is a huge time saver. Plus, since it’s built specifically for Solana, the integration feels native, not forced. Actually, wait—let me rephrase that. It’s like having a personal assistant who knows the ins and outs of Solana’s DeFi landscape.

But here’s a kicker: beyond just tracking, Solflare connects you directly to staking pools and yield farming protocols. So, you can stake your SOL or SPL tokens right within the wallet. That’s a neat trick. And no, it’s not some clunky browser extension that crashes every five minutes.

Seriously, if you haven’t checked it out, the solflare wallet download is worth a look. It’s not just another wallet; it’s a hub for managing your Solana DeFi journey. This part bugs me though—sometimes newer tokens or yield farms take a bit to show up in the app, so it’s not 100% comprehensive yet.

Why Yield Farming on Solana Needs Sharp Portfolio Insights

Yield farming is a bit like playing chess with your money. You gotta think several moves ahead—staking, withdrawing, reinvesting. But unlike chess, the board changes fast. For example, liquidity pool rewards might shift, or new SPL tokens get launched with better incentives. It’s a constant hustle.

At one point, I was juggling yield farming across three different protocols and totally forgot to claim rewards on one. Lost a decent chunk of SOL because of that. Oof. That’s where portfolio tracking becomes a lifesaver. You get a bird’s-eye view of what’s earning what, and where your tokens are locked up.

On one hand, yield farming can multiply your returns. Though actually, it comes with the hassle of tracking impermanent loss, fees, and token volatility. Without a clear dashboard, you’re flying blind. It’s not just about watching balances; it’s understanding how each SPL token in your portfolio performs in real-time.

And that’s another reason why a solid wallet with built-in portfolio tools beats generic trackers. You get updates tailored to Solana’s ecosystem, notifications on staking status, and sometimes even gas fee suggestions. (Oh, and by the way, Solflare’s fees are pretty reasonable compared to some other wallets I’ve tested.)

Handling SPL Tokens: The Unsung Heroes of Solana DeFi

SPL tokens are everywhere in Solana’s DeFi world. They represent everything from governance tokens to LP shares. But tracking them can feel like herding cats. Each token might have different staking rules, reward schedules, or lock-up periods.

Initially, I thought all SPL tokens were treated the same. Nope. Some tokens require manual claiming of rewards, others auto-compound. This inconsistency makes it super important to have a wallet interface that understands these nuances. Otherwise, you’re just guessing.

For me, the aha moment came when I realized my portfolio tracker wasn’t showing the yield on one of my less popular SPL tokens. That meant I was leaving free SOL on the table. After switching to a wallet with better SPL token support, I could optimize my farming strategy and actually see growth in my portfolio.

Honestly, the Solflare wallet download was part of that turnaround. It’s designed to handle SPL tokens gracefully, showing detailed breakdowns of your holdings and staking status. Plus, it’s constantly updated to support new tokens as the Solana ecosystem evolves.

Now, I’m not 100% sure if it’s perfect yet—some of the newer farming protocols still aren’t fully integrated—but it’s miles ahead of generic options. And hey, progress is progress.

Wrapping It Up (But Not Quite)

So, where does this leave us? Managing a Solana portfolio that includes yield farming and SPL tokens isn’t just about owning smart contracts or stacking coins. It’s about having the right tools that can handle the ecosystem’s quirks and pace.

Honestly, I used to dread tracking my DeFi earnings, but finding a solid wallet that doubles as a portfolio tracker changed the game. If you’re diving deep into Solana, I highly recommend giving the solflare wallet download a spin. It’s not perfect—few things are—but it’s a genuine step toward smarter, safer crypto management.

Anyway, this whole journey taught me one thing: in crypto, tools matter just as much as tokens. And keeping your eyes on the prize means more than just hoping your investments appreciate. It’s about staying informed, agile, and yes, a little obsessive sometimes. But hey, that’s part of the thrill, right?

Leave a Reply